Navigating the waters of Contracts for Difference (CFD) trading can be both thrilling and daunting. With its potential for high returns and inherent risks, having a solid trading strategy is essential for success.

This post will delve into various CFD trading strategies that can help traders maximise their profits while managing risks effectively. From trend following and CFD shares trading, this article has got you covered.

Understanding CFD Trading

CFDs are derivative products that allow traders to speculate on the price movements of various financial instruments without owning the underlying asset. Instead, traders enter into a contract with a broker to exchange the difference in the asset’s value from when the contract is opened to when it is closed.

Critical Advantages of CFD Trading

One of the primary advantages of CFD trading is leverage, which enables traders to control more prominent positions with a relatively small amount of capital. However, it’s crucial to remember that while leverage magnifies potential profits, it also amplifies losses.

Another advantage is the ability to profit from both rising and falling markets. Unlike traditional stock trading, where investors can only benefit from upward movements, CFDs allow traders to take short positions and profit from downward price movements.

CFD Trading Strategies

Trend Following Strategy

This strategy involves identifying and following the prevailing market trends. Traders look for assets experiencing consistent price movements in a particular direction and enter positions in line with the trend. Technical indicators such as moving averages and trend lines are commonly used to identify trends and potential entry points.

Range Trading Strategy

Range trading involves identifying price ranges within which an asset’s price tends to fluctuate. Traders aim to buy at the lower end of the range and sell at the higher end, profiting from the price oscillations. Support and resistance levels are key indicators used to identify potential entry and exit points.

Breakout Strategy

Breakout trading involves entering positions when the price breaks out of a predefined trading range or consolidative pattern. Traders aim to capture significant price movements following the breakout, potentially yielding substantial profits. However, breakout trading carries inherent risks, including false breakouts and whipsaws.

Scalping Strategy

Scalping is a short-term trading strategy that involves making multiple trades throughout the day to capitalise on small price movements. Traders aim to exploit minor fluctuations in price, often holding positions for just a few minutes or seconds. Scalping requires quick decision-making and disciplined risk management.

Fundamental Analysis Strategy

Fundamental analysis involves evaluating the underlying factors that drive the price movements of an asset, such as economic indicators, corporate earnings, and geopolitical events. Traders using this strategy aim to identify undervalued or overvalued assets based on their fundamental characteristics and market sentiment.

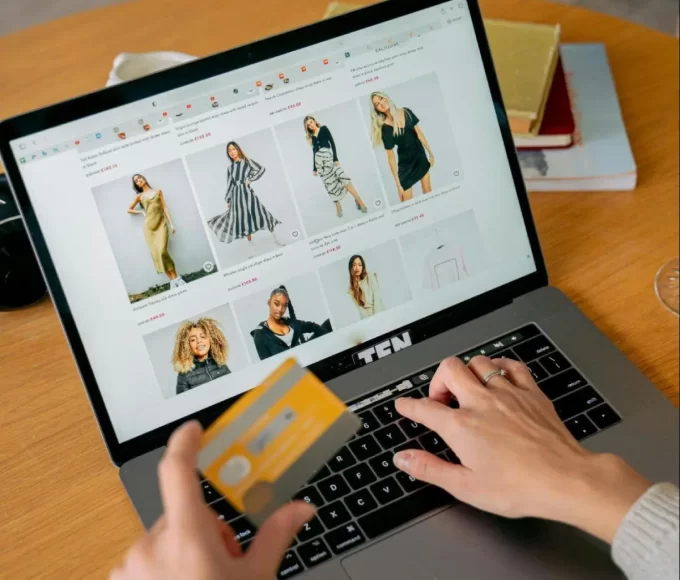

CFD Shares Trading

In addition to trading currencies, commodities, and indices, CFDs also offer opportunities for trading shares of publicly traded companies. CFD share trading allows traders to speculate on the price movements of individual stocks without owning the underlying shares. This flexibility enables traders to capitalise on both short-term price fluctuations and long-term trends in the equity markets.

One of the primary advantages of trading CFD shares is the ability to access a diverse range of markets with ease. Instead of opening multiple brokerage accounts to trade different stocks, traders can access a wide variety of shares from various sectors through a single CFD trading platform. This convenience allows for greater flexibility and efficiency in managing trading portfolios.

It offers the opportunity for leverage, similar to other CFD instruments. With leverage, traders can control more significant positions with a smaller amount of capital, potentially magnifying profits. However, it’s essential to exercise caution when using leverage, as it also increases the level of risk and potential losses.

Another advantage of CFD shares trading is the ability to profit from both rising and falling markets. Traditional stock trading typically requires buying shares in anticipation of price appreciation. However, with CFDs, traders can also take short positions, allowing them to profit from downward price movements by selling shares they don’t own and repurchasing them at a lower price.

Risk Management

Effective risk management is crucial for success in CFD trading. Traders should implement risk management techniques to protect their capital and minimise potential losses. This includes setting stop-loss orders to limit downside risk, diversifying their trading portfolio to spread risk across different assets, and avoiding over-leveraging positions.

Additionally, maintaining a disciplined approach to position sizing and adhering to predetermined risk-reward ratios can help traders stay resilient in the face of market volatility. By prioritising risk management, traders can safeguard their capital and preserve their profitability over the long term.

CFD trading offers a wide range of opportunities for traders to profit from various financial markets. By employing the right trading strategies and risk management techniques, traders can maximise their profits while mitigating potential losses. Whether you prefer trend following, range trading, breakout trading, scalping, or fundamental analysis, there’s a strategy that suits your trading style and objectives.