Over the past decade, the investment world has undergone a lot of changes. From the rise of cryptocurrencies to the increase in popularity of retail trading, traditional finance is no longer the playground of institutional investors only. One of the most significant developments that drives this shift is the rise of proprietary trading firms, also known as “prop trading” firms, such as the Supertrade trading platform. These companies not only reshape the way traders access markets, but they also create new opportunities for individuals and professional traders.

Prop trading firms use cutting-edge platforms to provide traders with direct market access, real-time data, and performance analytics. Unlike traditional brokerages, prop firms often allow traders to operate with the firm’s capital. Traders don’t need to use their own money. It means that they can trade at a much larger scale and potentially generate higher profits without risks to personal finances.

What Are Prop Trading Firms?

Proprietary trading firms use their own money to trade financial markets and generate profits. They don’t rely on client deposits or manage investment portfolios like hedge funds. Instead, they recruit and train skilled traders, give them access to capital and tools, and share profits from successful trades.

Many prop firms operate on a “performance-based” model. Traders receive a share of the profits they generate, often split between 70/30 or even 90/10 in favor of the trader. If a trader consistently performs well, they may be allocated more capital over time. This model attracts talented individuals who may not have large amounts of personal funds to trade with.

Lower Barrier to Entry

One of the main ways in which prop firms transform the investment landscape is by lowering the barrier to entry. In the past, a trader had to have a job at a big bank or an investment house. For that, he needed years of education and a lot of useful connections. Today, anyone with a computer, an internet connection, and the skill to pass a firm’s evaluation process can get funded.

Most firms allow traders to use a demo challenge or simulation. They must meet specific performance criteria (like profit targets and risk management rules). If they pass, they are offered a funded account. This “pay-to-play” structure, where traders pay an evaluation fee to get started, has become standard. But in return, successful traders can manage big accounts with no risks to personal capital.

Advanced Tools and Real-Time Data

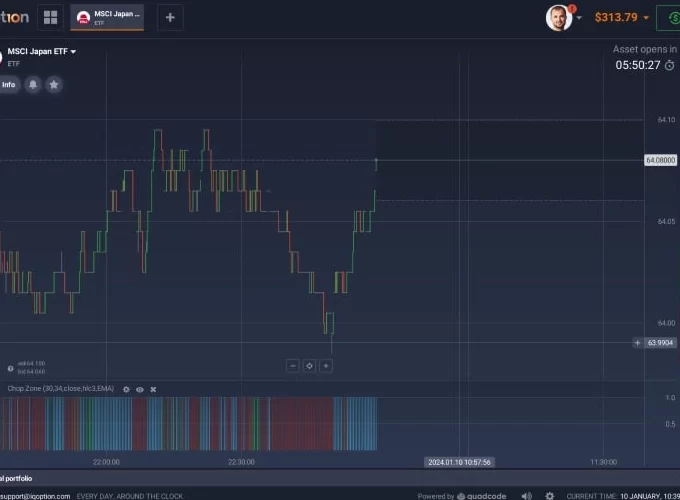

Prop trading firms often give their traders access to professional-grade tools that would otherwise be too expensive for individual use. These tools include:

- Real-time market data and advanced charting software

- Proprietary algorithms or trading signals

- Risk dashboards where they can monitor performance and exposure

- Simulated environments to practice and backtest strategies

Traders can test strategies, adapt to changing market conditions, and make data-driven decisions faster than ever before.

Shaping a New Generation of Traders

Another major impact of prop trading firms is the rise of a new kind of trader: independent, self-directed, and performance-driven. These aren’t Wall Street veterans in suits. They are often young, tech-savvy individuals from all over the world. They may be students, software engineers, or full-time traders working remotely.

Prop firms have helped create global trading communities through online leaderboards, coaching programs, webinars, and mentorship. Traders learn from each other, share strategies, and grow faster than they might in isolation.

Prop Trading Firms Change Market Dynamics

Prop trading firms also start to impact the markets themselves. There are thousands of independent traders who participate in major financial markets through firm capital. They can now even shape short-term price movements. This can lead to:

- More intraday volatility

- Faster responses to news and economic data

- More liquidity in certain asset classes like forex and crypto

More traders use automated tools or follow momentum-based strategies. This is why markets are becoming more technical in nature. It means that price charts, volume, and indicators play a bigger role than traditional valuation methods.

Are There Any Risks?

Prop trading comes with some risks. While traders don’t risk their own money (in most models), they face pressure to perform. If they fail to meet risk guidelines or incur losses, it can result in account suspension or termination. Additionally, evaluation fees and tight rules may be difficult for beginners to manage.

It’s also important to research the reputation and transparency of any firm. Not all firms are created equal: some offer better support, more realistic challenges, or faster payouts than others.

The Future of Prop Trading

Technology continues to evolve and financial markets become more decentralized. Prop trading firms are expected to play an even bigger role in the global investment landscape. We can expect to see:

- Greater integration with crypto and DeFi trading

- AI-powered analytics and trade automation

- More flexible funding models and reduced evaluation fees

- Wider access in developing regions

Prop firms aren’t replacing traditional investing; they complement it. They create new pathways for ambitious individuals to trade professionally and inject fresh talent and innovation into the current financial system.