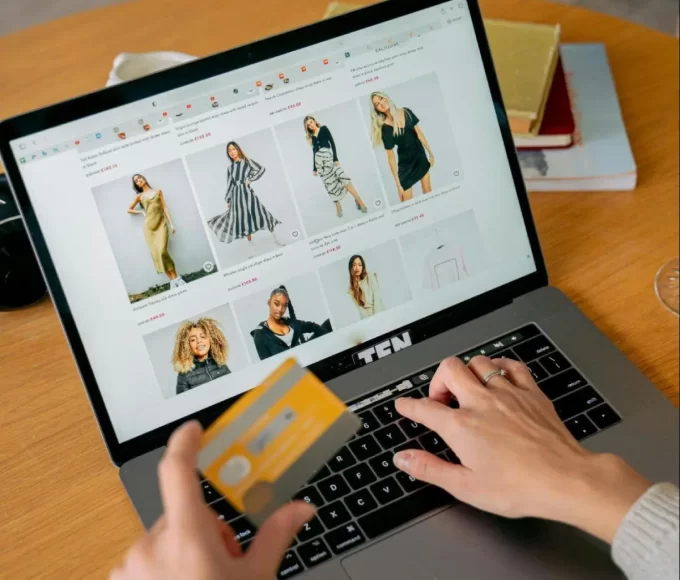

In an era of rapid technological advancement and increasing digital interconnectivity, the security of financial assets has become a paramount concern. Traditional financial systems, while robust in many ways, are not immune to threats such as fraud, hacking, and identity theft. Digital currency, facilitated by innovations such as white label debit cards, offers a transformative approach to enhancing financial security. This blog post delves into how digital currency can protect your assets and strengthen financial security in today’s digital economy.

The Vulnerabilities of Traditional Financial Systems

Traditional financial systems, encompassing banks, credit card companies, and other financial institutions, have long been the backbone of global commerce. However, they also come with inherent vulnerabilities:

Centralization: Centralized databases are prime targets for hackers, who can access vast amounts of sensitive information if they breach security measures.

Intermediaries: The involvement of multiple intermediaries in transactions increases the risk of data breaches and fraud.

Slow Processing Times: Traditional financial transactions can take several days to process, creating opportunities for fraudsters to exploit the delay.

The Rise of Digital Currency

Digital currency, particularly cryptocurrencies like Bitcoin and Ethereum, offers a new paradigm for financial transactions. Built on blockchain technology, digital currency introduces several key features that enhance financial security:

Decentralization: Transactions are recorded on a decentralized ledger, reducing the risk of a single point of failure.

Encryption: Transactions are encrypted, ensuring that data is protected from unauthorized access.

Transparency: The blockchain ledger is transparent and immutable, making it difficult for malicious actors to alter transaction records.

White Label Debit Cards: Bridging the Gap

White label debit cards, which allow users to spend digital currency just like traditional currency, are an innovative way to bridge the gap between the old and new financial systems. These cards offer several security advantages:

Secure Transactions: White label debit cards use advanced encryption and secure chip technology to protect transaction data.

Instant Conversion: They facilitate the instant conversion of digital currency to fiat currency, reducing exposure to market volatility.

User Anonymity: While complying with regulatory standards, these cards can offer enhanced privacy features compared to traditional banking cards.

Enhancing Financial Security with Digital Currency

Decentralization:

Digital currency operates on decentralized networks, distributing transaction data across multiple nodes. This decentralization significantly reduces the risk of data breaches and hacking, as there is no central repository of information to target.

Immutable Transactions:

Transactions recorded on the blockchain are immutable and cannot be altered or deleted. This feature ensures that transaction histories are tamper-proof, providing an additional layer of security against fraud and unauthorized modifications.

Encryption and Privacy:

Digital currency transactions are encrypted, safeguarding sensitive information from cybercriminals. Additionally, users can maintain a higher degree of privacy, as transactions are pseudonymous, with identities represented by cryptographic addresses.

Smart Contracts:

Many digital currency platforms support smart contracts, self-executing contracts with the terms of the agreement directly written into code. These contracts automatically enforce the terms, reducing the risk of human error and fraud.

The Role of White Label Debit Cards

White label debit cards enhance the security benefits of digital currency by providing a familiar and user-friendly interface for transactions. Here’s how they contribute to financial security:

Multi-Factor Authentication (MFA): White label debit cards often incorporate MFA, requiring users to verify their identity through multiple methods, such as passwords, biometrics, or one-time codes.

Real-Time Monitoring: Advanced fraud detection systems monitor transactions in real-time, identifying and flagging suspicious activity.

Regulatory Compliance: These cards adhere to stringent regulatory standards, ensuring that transactions are secure and compliant with legal requirements.

Case Studies and Examples

Secure Spending with XYZ Debit Card:

XYZ Debit Card, a leader in white label debit card solutions, offers users a secure way to spend digital currency. With features such as MFA, end-to-end encryption, and real-time fraud monitoring, XYZ Debit Card ensures that users can transact with confidence.

Financial Protection with ABC Debit Card:

ABC Debit Card employs state-of-the-art security measures to protect users’ assets. By leveraging secure chip technology and biometric authentication, ABC Debit Card provides a robust defense against unauthorized access and fraud.

Future Outlook and Conclusion

As digital currency continues to gain traction, its role in enhancing financial security becomes increasingly evident. By leveraging the inherent security features of blockchain technology and the user-friendly interface of white label debit cards, individuals and businesses can protect their assets more effectively than ever before. The adoption of digital currency is not just a technological shift; it is a step towards a more secure and resilient financial future.

In conclusion, digital currency, supported by white label debit cards, offers a powerful solution to the security challenges of the modern financial landscape. By embracing these innovations, we can safeguard our financial assets and build a more secure, transparent, and efficient financial system for the future.