Buying a home is a significant financial milestone, often seen as a gateway to stability and long-term investment. Many prospective homeowners focus on securing a mortgage, calculating monthly payments, and considering property taxes. However, the financial responsibilities of owning a home extend far beyond these obvious costs.

Whether purchasing a home in Oklahoma or elsewhere, failing to account for the hidden expenses of homeownership can lead to unexpected financial strain, making it crucial to understand all potential costs before making a purchase.

Understanding Mortgage-Related Expenses

While buyers typically calculate their mortgage payments based on principal and interest, there are additional costs that can impact affordability. For instance, homeowners’ insurance is a requirement for nearly all mortgage lenders. The price varies based on location, home value, and coverage levels, but it can add a significant amount to monthly expenses. Similarly, private mortgage insurance (PMI) is often required for buyers who make a down payment of less than 20%. This additional cost is meant to protect the lender and can add hundreds of dollars annually to a homeowner’s expenses.

Additionally, buyers need to factor in property taxes, which vary depending on the home’s assessed value and local tax rates. These taxes can increase over time due to reassessments or changes in local government policies. For those exploring homeownership, securing a mortgage with favorable terms is a priority. Factors such as interest rates and lender requirements play a crucial role, and in states like Oklahoma mortgage rates can significantly influence affordability. However, even with a competitive rate, overlooking costs like property taxes and insurance can create financial strain.

Routine Maintenance and Repairs

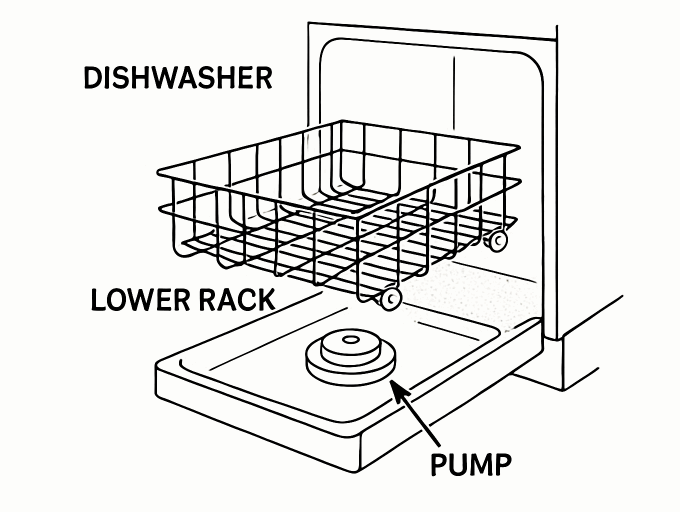

One of the most overlooked costs of homeownership is ongoing maintenance. Unlike renting, where landlords handle repairs, homeowners are responsible for keeping their property in good condition. Basic upkeep such as lawn care, gutter cleaning, and HVAC servicing can add up quickly. While these may seem like minor expenses individually, they can become a financial burden when combined.

Additionally, homeowners should prepare for unexpected repairs. Major systems within a home, such as plumbing, electrical wiring, and the roof, have limited lifespans. A water heater may fail, pipes could leak, or a storm may damage the roof. Repairing or replacing these essential components can cost thousands of dollars. Without a dedicated emergency fund, homeowners may find themselves in a difficult financial position when faced with an urgent repair.

The Cost of Home Improvements

Many homebuyers move into a property with the intention of making upgrades over time. While some improvements are optional, others become necessary due to outdated systems or wear and tear. Remodeling a kitchen, updating bathrooms, or replacing old flooring can quickly escalate in cost. Even smaller projects, such as repainting or upgrading appliances, require a financial commitment.

Moreover, certain renovations may be required to maintain the value of the home. If comparable properties in the neighborhood undergo upgrades, homeowners who fail to keep up with modernization may find their home depreciating in value over time. Investing in improvements is often essential not just for comfort but also for preserving the property’s worth in the market.

Utility Bills and Energy Costs

When transitioning from renting to homeownership, many buyers underestimate the difference in utility expenses. Larger living spaces and different heating or cooling systems can lead to significantly higher electricity, gas, and water bills. New homeowners may also encounter hidden energy inefficiencies, such as poor insulation, outdated windows, or an old HVAC system, all of which can increase energy consumption.

To mitigate high utility costs, some homeowners opt for energy-efficient upgrades like smart thermostats, better insulation, or solar panels. While these investments can lead to savings in the long run, they require an upfront financial commitment. Without proper budgeting, homeowners may find themselves struggling to balance high energy bills with the cost of making energy-efficient improvements.

HOA Fees and Community Costs

For those purchasing homes in planned communities, homeowners association (HOA) fees are an added expense. These fees cover community amenities, landscaping, and sometimes even external maintenance. However, they can vary significantly depending on the neighborhood and the services provided. Some HOAs charge only a modest monthly fee, while others require substantial payments that can rival a mortgage installment.

Pest Control and Home Security

Maintaining a home involves more than just structural repairs—it also includes preventative measures against pests. Infestations of termites, rodents, or insects can lead to significant damage, sometimes costing thousands of dollars in extermination and repair. Routine pest control services are essential, especially in areas prone to specific infestations.

Similarly, home security is an expense many homeowners overlook. Whether through professional security systems, cameras, or reinforced locks, securing a property can require additional investment. While these measures enhance safety and provide peace of mind, they come with recurring costs, such as monitoring fees or equipment maintenance.

Homeowner Responsibilities Beyond the Property

Many new homeowners focus solely on the costs associated with their house itself but overlook responsibilities related to the surrounding property. Landscaping is one such area. Maintaining a lawn, trimming trees, and keeping pathways clear requires time and money. Some homeowners may choose to handle these tasks themselves, while others hire professionals, adding a recurring cost to their budget.

The Risk of Property Depreciation

While many view real estate as a solid investment, property depreciation is a real concern in certain market conditions. Economic downturns, neighborhood decline, or changes in zoning laws can all contribute to a decrease in property value. Homeowners relying on appreciation to build equity may find themselves in a difficult position if their property does not retain its expected worth.

Additionally, unforeseen circumstances such as environmental issues or changes in infrastructure planning can negatively impact property values. Homeowners who purchase without considering long-term neighborhood trends may experience financial losses if they need to sell sooner than expected. All in all, owning a home is often seen as a financially responsible decision, but the true cost extends beyond the monthly mortgage payment. From maintenance and repairs to hidden community fees and rising utility bills, homeownership comes with numerous expenses that can strain even the most carefully planned budget.